I posted this article on April 9.

April 10, the U.S. government announced a further increase in the "reciprocal tariffs" on Chinese goods imported into the U.S., raising the rate to 125%.

April 11, China announced another increase in tariffs on U.S. goods to 125% and stated that, “Given the current tariff levels, American goods exported to China already have no market acceptability. If the U.S. continues to impose additional tariffs on Chinese goods in the future, China will disregard them.”

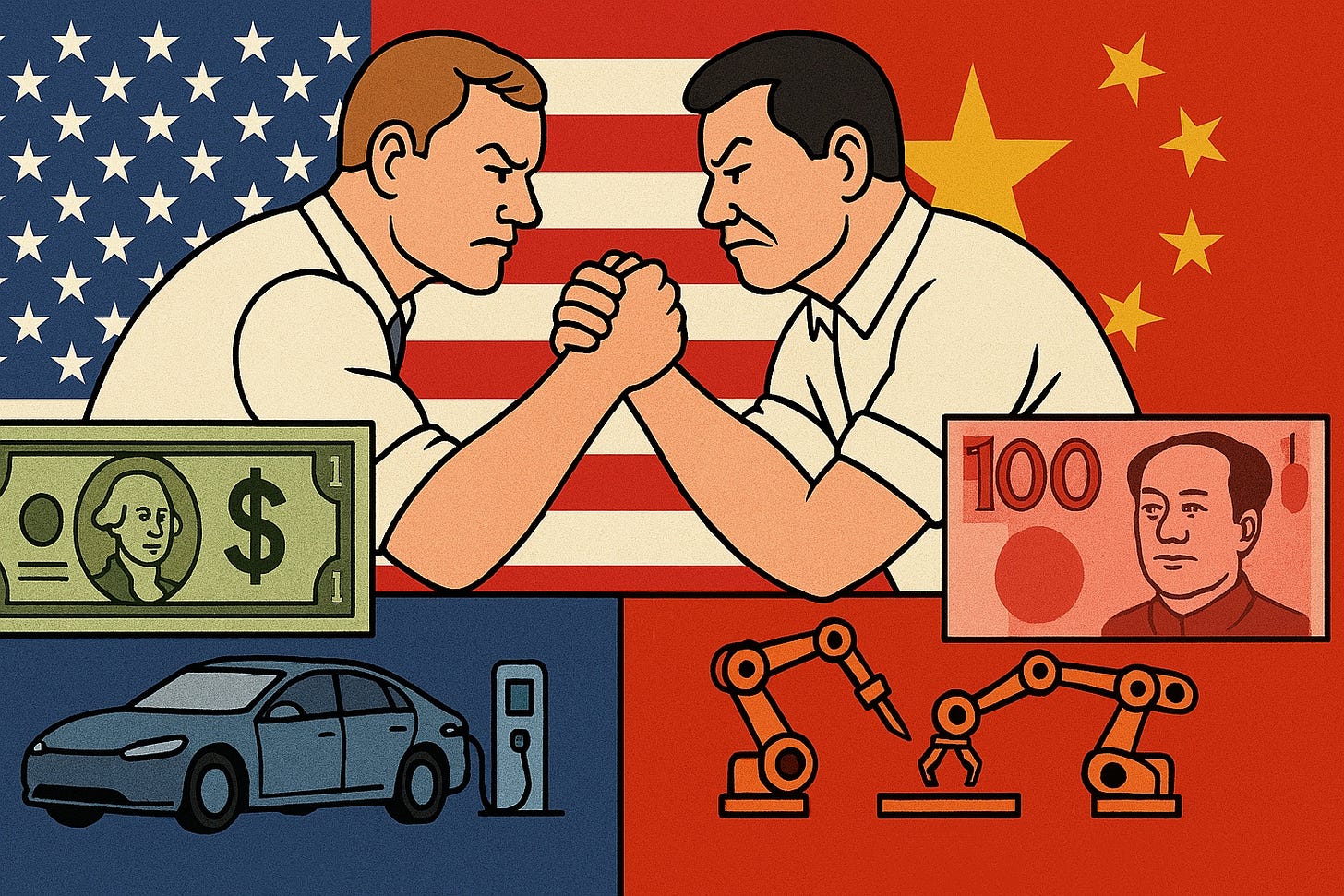

In a renewed escalation of trade tensions, U.S. President Donald Trump has once again taken aim at Chinese exports—this time proposing an additional 50% tariff, on top of previous rounds. If implemented, these tariffs would amount to a staggering 104% on Chinese goods entering the U.S. market.

In response, China acted swiftly and decisively. Within 24 hours, Beijing matched the tariff hike with its own set of countermeasures—raising tariffs by 34% on U.S. imports, restricting the export of rare earth materials, and tightening regulations on 11 American companies operating in China. Meanwhile, all negotiation channels between China and the U.S. have come to a standstill.

Unlike the 2018 trade war, when China initially responded with restraint, the tone this time is strikingly different. Why is China more confident this time?

Much of this confidence can be traced back to a long-term national strategy known as “Made in China 2025.”

Launched in 2015, this plan set out to transform China from a manufacturing giant into a global leader in high-tech industries within a decade. Key sectors targeted include electric vehicles (EVs), semiconductors, biotechnology, advanced robotics, and clean energy.

Now in its final year, several international assessments—including those from South China Morning Post and BBC—have noted that China has achieved roughly 86% of the plan’s stated goals. U.S. politicians have taken note too. In a 58-page report, U.S. Secretary of State Marco Rubio acknowledged China’s leading position in electric vehicles, shipbuilding, energy infrastructure, and high-speed rail.

One standout example is China’s EV industry. Back in 2015, the goal was to produce 3 million EVs by 2025. That benchmark was reached in 2021. By 2024, annual output exceeded 12 million units—more than 50% of the domestic car market. China now produces 70% of all EVs globally and has become the world’s largest car exporter.

This was not a result of market forces alone. The Chinese government played an active role by offering targeted subsidies, tightening technical standards year by year, and implementing a “dual credit” policy that pushed automakers to prioritize clean energy.

While EVs often steal the headlines, China's shipbuilding industry tells an equally powerful story of industrial ascendancy.

According to the Rubio report, China’s shipbuilding capacity now exceeds that of the U.S. by more than 200 times. Fueled by low-cost steel production, skilled labor, and a well-integrated industrial base, China has outpaced traditional leaders like Japan and South Korea to become the undisputed global leader in commercial shipbuilding.

From cargo ships and tankers to increasingly complex vessels, China’s shipyards are now responsible for a significant portion of global orders. This sector not only reflects industrial strength but also has strategic implications for global trade and naval projection.

China’s rise in shipbuilding mirrors a broader trend: transforming low-end production into high-value, technically advanced manufacturing—just as outlined in the “Made in China 2025” blueprint.

In addition to strong policy support, China’s advantage lies in its dense industrial clusters, highly skilled workforce, and capacity for rapid scaling. From semiconductors to robotics, industries have been nurtured through a combination of domestic innovation and strategic overseas acquisitions—such as the German robotics company KUKA, acquired by Chinese firm Midea.

These are not just price-based advantages. China’s supply chain strength, speed to market, and manufacturing depth are proving difficult to replicate—even in lower-wage countries like India or Vietnam.

At the heart of the U.S. trade war is more than just concern over trade imbalances. It’s a structural worry that China is moving up the value chain—fast—and potentially challenging America’s global economic leadership.

Rubio’s report openly warns that if China’s manufacturing dominance continues unchecked, it may reshape global values and norms—not just supply chains. He argues that even if China were to plateau economically, the competitive pressure it exerts will persist for decades.

The “Made in China 2025” strategy reflects a different economic model—state-guided but market-driven. While it has drawn criticism for being top-down and overly ambitious, it has demonstrated a clear ability to coordinate resources, guide innovation, and adapt policy in real time.

This model has sparked debates in the West about the future of globalization. Should manufacturing leadership be left solely to market forces? Or is there room for strategic industrial policy?

With China now accounting for 35% of global manufacturing output, compared to the U.S.’s 12%, the stakes are high. The current trade tensions are not just about tariffs—they’re about who defines the future of manufacturing, innovation, and economic influence.

Whether this confrontation results in deglobalization or a restructured world order remains to be seen. But one thing is clear: China is no longer just a player in the global manufacturing game—it’s aiming to lead it.